Loan Transaction

Internal Control

Approval Service

Issue/Reissue

Digital Certificate

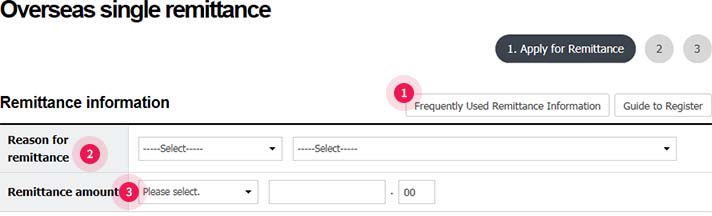

Step 1. Prepare application for overseas remittance

- ① Can import Frequently Used Remittance Information to reuse it

- ② Select a reason for remittance. If there is no relevant reason, please select ‘Other.’ Then the branch will check and change it.

- ③ Enter remittance currency and amount.

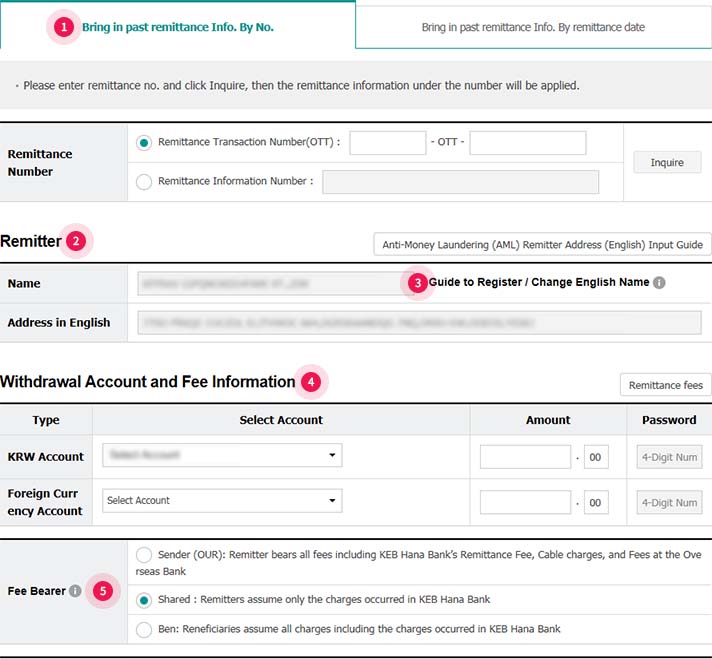

Step 2. Prepare for application for overseas remittance

- ① Can prepare application by importing remittance information number and past remittance information

- ② Remitter’s information can be used only when it is pre-registered with a branch

- ③ In case of sole proprietor, remittance under the name of company is possible only when English company name is pre-registered with the Bank

- ④ Enter withdrawal account/amount based on remittance amount.

- ⑤ Select a remittance fee bearer

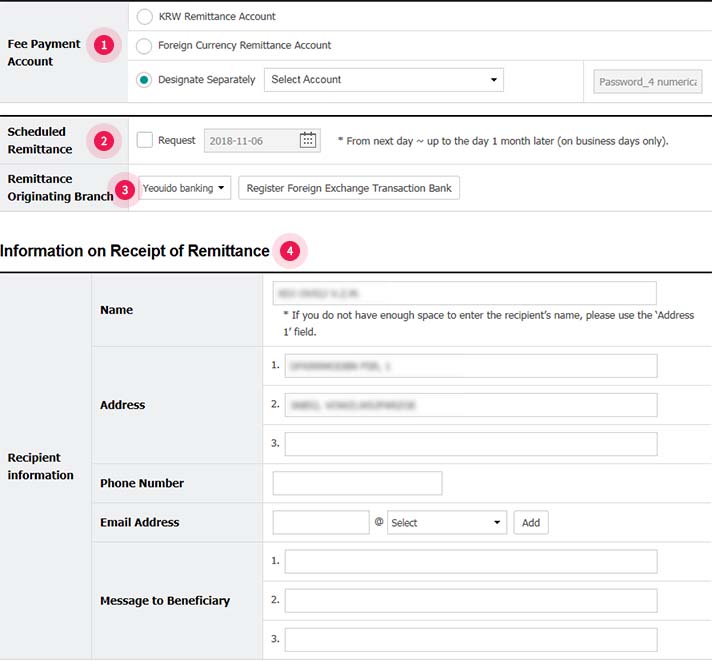

Step 3. Prepare application for overseas remittance

- ① Select an account for fee withdrawal

- ② If you tick a Scheduled Remittance Request, you can enter the scheduled date of remittance (For up to a month from the next day)

- ③ Select a Remittance Originating Branch. It is necessary to send documentary evidence

- ④ Enter the recipient information.

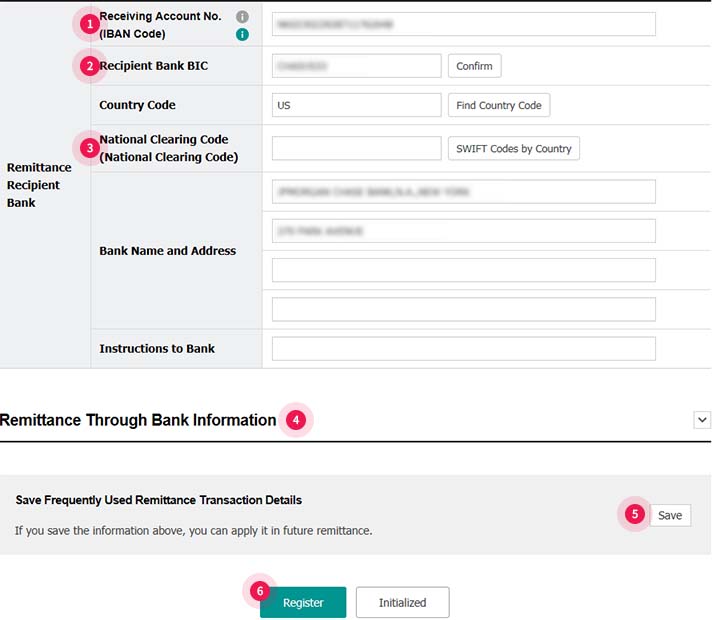

Step 4. Prepare application for overseas remittance

- ① Enter beneficiary account number or IBAN code depending on the country

- ② If clicking on Confirm after entering BIC code, you can import country code, bank name and bank address.

- ③ If there is bank code by country, enter the code including

- ④ If clicking on ⅴ, input window will appear.

- ⑤ If you save it as Frequently Used Remittance Transaction Details, you can use the information again when you prepare application going forward.

- ⑥ If clicking on Register, it is put in Remittance Application Details

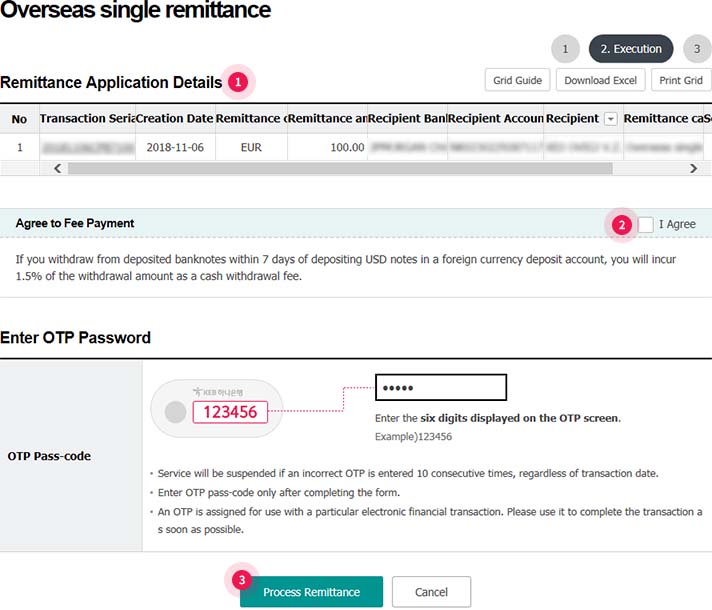

Step 5. Request to execute remittance after checking Remittance Application Details

- ① Please check remittance application details

- ② If USD cash is in foreign currency withdrawal account, a cash fee will be charged. Please check details and tick the box of “I Agree”.

- ③ If clicking on Process Remittance after entering OTP password, input window for digital certificate will appear.

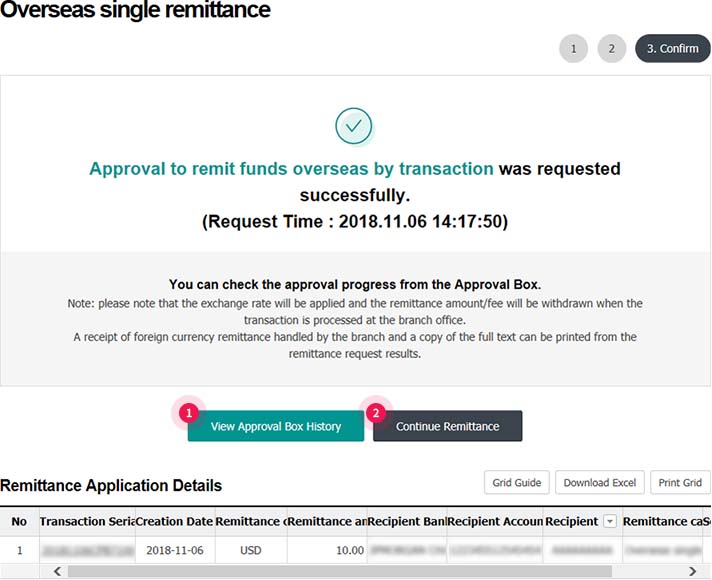

Step 6. Complete application for remittance

- ① Please check the status of remittance. Send supporting documents to the relevant branch and check if application has been received normally.

- ② Click on Continue Remittance if you wish to continue to prepare application